Daily: Is no news bad news?; Intel might need to breakup; Samsung's HBMs in AMD chips

6 min read.

Highlights

Is no news bad news? Not much news following the U.S.-China trade talks last week. Everyone went home after photos and handshakes to get confirmation from their respective leaders and then, to hash out the details. There has been incremental loosening on the PRC rare earths licensing side and virtually nothing on US export controls side (chips or otherwise).

Meanwhile, the PRC is making it difficult for the Synopsys / Ansys merger to go ahead. The PRC, like the US, has a long and creative list of things it can do to inflict pain against competitors and adversaries. China’s toolkit has matured after lessons learnt from Trump 1, Biden, and the sanctions posed on Russia during the Ukraine war. The Chinese side has signalled this, but the American side has yet to be especially clear-eyed about who they are dealing with.

Elsewhere, Taiwan imposed its own export controls on Huawei and SMIC, China’s largest semiconductor foundry.

Intel might need to breakup. A long piece in WSJ about how Intel may need to break up to survive. TrendForce reports that Intel is also looking at another round of layoffs next month, with rumours pointing to Intel Foundry as the target of the restructuring.

Samsung’s HBMs in AMD chips. Good news for Samsung as they became the supplier of 12-layer HBM3Es for AMD’s latest MI350 AI accelerators, which AMD claims can compete with Nvidia’s latest chips. Following this, Samsung is hopeful that they might be able to also supply AMD’s MI400 series with HBM4 next year.

Thanks for reading.

1. Policy and Geopolitics

1.1

Bloomberg (06/15): Taiwan Imposes Technology Export Controls on Huawei, SMIC

Taiwan has blacklisted Huawei Technologies Co. and Semiconductor Manufacturing International Corp., dealing another major blow to the two companies spearheading China’s efforts to develop cutting-edge AI chip technologies.

Taiwan’s International Trade Administration has included Huawei, SMIC and several of their subsidiaries in an update of its so-called strategic high-tech commodities entity list, according to the latest version that was made available on its website on Saturday. The administration confirmed the changes were made recently, following Bloomberg’s report.

1.2

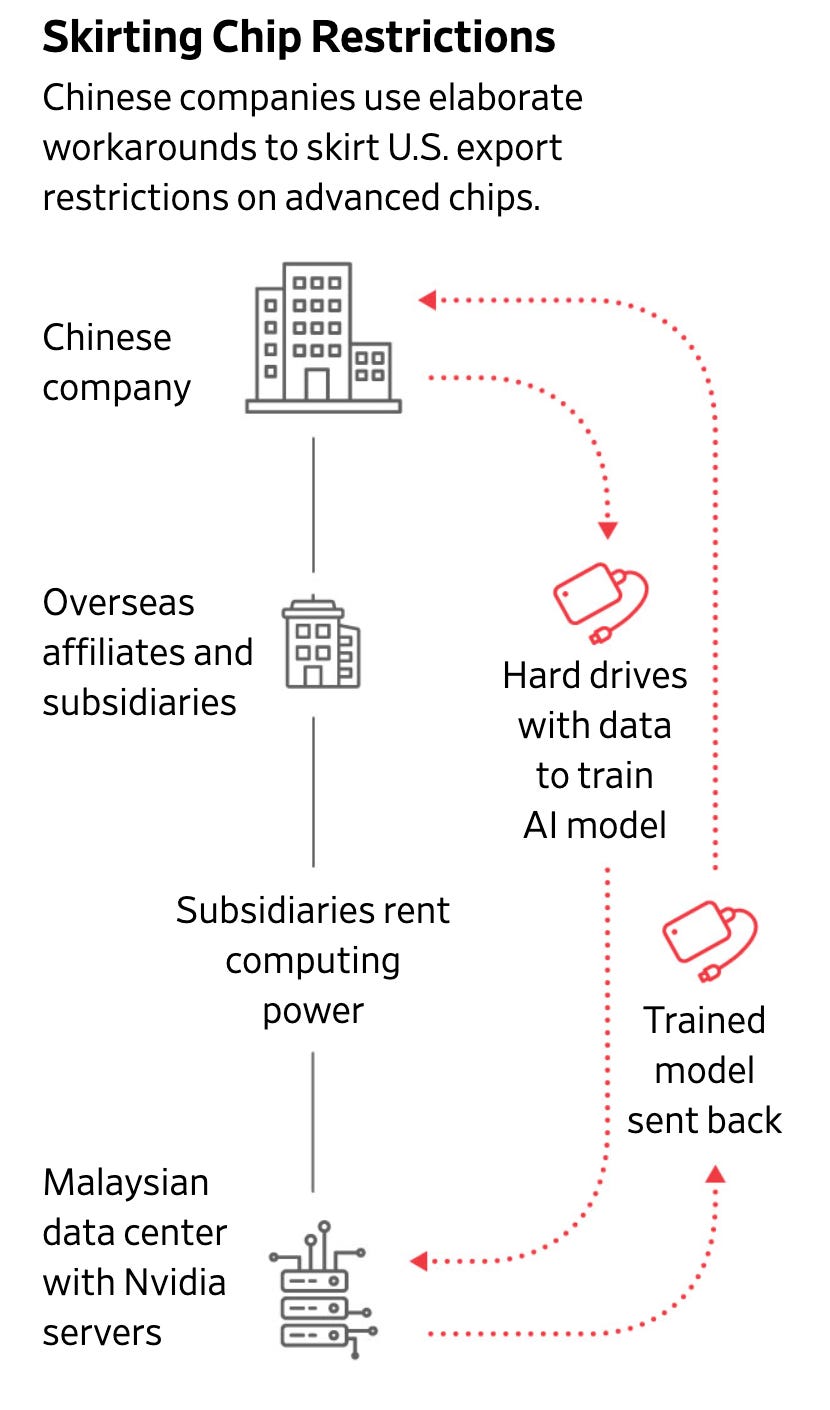

WSJ (06/12): Chinese AI Companies Dodge U.S. Chip Curbs by Flying Suitcases of Hard Drives Abroad

Since 2022, the U.S. has tightened the noose around the sale of high-end AI chips and other technology to China over national-security concerns. Yet Chinese companies have made advances using workarounds.

In some cases, Chinese AI developers have been able to substitute domestic chips for the American ones. Another workaround is to smuggle AI hardware into China through third countries. But people in the industry say that has become more difficult in recent months, in part because of U.S. pressure.

That is pushing Chinese companies to try a further option: bringing their data outside China so they can use American AI chips in places such as Southeast Asia and the Middle East.

1.3

FT (06/13): China delays approval of $35bn US chip merger amid Donald Trump’s trade war

A $35bn US semiconductor industry merger is being delayed by Beijing’s antitrust regulator, after Donald Trump tightened chip export controls against China in a move that exacerbated trade tensions between the world’s two largest economies.

China’s State Administration for Market Regulation has postponed its approval of the proposed deal between Synopsys, a maker of chip design tools, and engineering software developer Ansys, according to two people with knowledge of the matter.

The transaction between the American groups, which has received the blessing of authorities in the US and Europe, had already entered the last stage of SAMR’s approval process and was expected to be completed by the end of this month, said the people.

2. Economy, Finance, and Business

2.1

WSJ (06/13): The Only Remedy for Intel’s Woes May Be a Breakup

To emerge from a yearslong financial and technological rut, Intel needs to better compete with chip makers like Taiwan Semiconductor Manufacturing Co. It looks increasingly like that will require breaking up the company.

The storied chip maker for decades minted money by designing and making its own chips in its own factories. The model worked well when the company was making the fastest-calculating chips with the smallest transistors in the world.

That changed more than a half decade ago, after TSMC and South Korea’s Samsung Electronics took the chip-making lead. Both are contract chip-makers, which meant any of Intel’s competitors in chip design, from Nvidia to Advanced Micro Devices, had access to better factories.

2.2

TrendForce (06/16): Intel Reportedly to Launch Mid-July Layoffs, Mass Cuts to Hit Global Manufacturing

Intel has reportedly informed its factory employees this month that layoffs will begin in mid-July, with the initial round expected to be completed by the end of the month, as disclosed in an internal memo from executives reviewed by OregonLive.

The memo does not specify how many jobs Intel intends to cut or which areas will be affected, the report notes. Meanwhile, Techgig points out that the layoffs will mostly impact Intel’s factory workforce, with its internal manufacturing arm—Intel Foundry—at the center of the restructuring.

Notably, according to ijiwei, Chinese social media users have also reported that Intel China may carry out layoffs affecting up to 20% of staff, with some teams facing even deeper cuts. The outcome is reportedly expected later this month, ijiwei notes.

2.3

Bloomberg (06/15): Amazon Plans $13 Billion Investment in Australia Data Centers

Amazon.com Inc. plans to invest A$20 billion ($13 billion) in Australia between this year and 2029 to develop its data-center infrastructure.

The commitment would support the growth in demand in Australia for cloud computing and AI, for which it would speed up adoption and capability, Amazon said in a statement.

3. Technology

3.1

TrendForce (06/13): Micron Confirms DDR4 Phase-Out with EOL Notices; Reportedly Hints at Price Hikes Ahead

Micron’s EVP confirmed the company has sent end-of-life (EOL) notices for DDR4 and LPDDR4 to PC and data center customers.

According to the reports, Micron Executive VP and Chief Business Officer Sumit Sadana revealed that the U.S. memory giant has already issued end-of-life (EOL) notices for DDR4 and LPDDR4 to customers. MoneyDJ suggests that Micron’s DDR4 shipments will end in 2–3 months and hinted at price hikes ahead to fuel future investments and R&D.

Production for these segments is expected to wind down after Q1 2026, IT Home adds.

3.2

Chosun Daily (06/13): Samsung secures AMD contract for HBM3E 12-stack, clears defect concerns

Samsung Electronics has secured a key supply deal with AMD, with its fifth-generation 12-layer HBM3E memory selected for the chipmaker’s upcoming MI350 AI accelerators. The move marks a breakthrough for Samsung, which has repeatedly lost out to rivals like Nvidia, and helps ease concerns about the reliability of its HBM technology.

With the deal confirmed, Samsung is buoyed by the momentum, especially as expectations grow for future HBM4 (sixth-generation HBM) supply to AMD’s MI400 series, set to launch next year. Industry observers also believe Samsung may begin supplying HBM3E to Nvidia as early as this month, potentially accelerating the company’s HBM business in the second half.

3.3

Reuters (06/13): AMD turns to AI startups to inform chip, software design

Advanced Micro Devices has forged close ties to a batch of artificial intelligence startups as part of the company's effort to bolster its software and forge superior chip designs.

As AI companies seek alternatives to Nvidia's chips, AMD has begun to expand its plans to build a viable competing line of hardware, acquiring companies such as server maker ZT Systems in its quest to achieve that goal.

But to build a successful line of chips also requires a powerful set of software to efficiently run the programs built by AI developers. AMD has acquired several small software companies in recent weeks in a bid to boost its talent, and it has been working to beef up its set of software, broadly known as ROCm.

3.4

Reuters (06/13): AMD unveils AI server as OpenAI taps its newest chips

Advanced Micro Devices CEO Lisa Su on Thursday unveiled a new artificial intelligence server for 2026 that aims to challenge Nvidia's flagship offerings as OpenAI's CEO said the ChatGPT creator would adopt AMD's latest chips.

Su took the stage at a developer conference in San Jose, California, called "Advancing AI" to discuss the MI350 series and MI400 series AI chips that she said would compete with Nvidia's Blackwell line of processors.

The MI400 series of chips will be the basis of a new server called "Helios" that AMD plans to release next year.