Highlights

Micron to invest $200b. Micron announced that they will spend US$200 billion in manufacturing and R&D investment on U.S. soil. Approximately $150 billion will go to expanding domestic manufacturing and $50 billion will go to R&D. This is a big flashy pledge, on par with others in the Trump era, especially given that the CHIPS Act is being renewed and semiconductor tariffs could be on the horizon. But notably, these investments had already previously been planned, and were only increased by about $30 billion, or some 15%. This bump is also likely fuelled by recent positive developments in Micron’s HBM4 production, which as I wrote yesterday, seems to have surpassed Samsung.

AMD’s latest chips. AMD CEO Lisa Su says that their latest chips, MI350, are faster than their Nvidia competitors. The data center builder Crusoe is reportedly purchasing $400 million worth of AMD’s MI355X AI chips.

HBM news roundup. Samsung is reportedly still having difficulty with getting their 12 layer HBM3Es certified for use with Nvidia’s AI chips. And a KAIST professor unveiled a roadmap for HBM4 to HBM8 from 2025 to 2040, proposing that cooling will become a key element in developing HBM5s.

Thanks for reading.

1. Policy and Geopolitics

1.1

Bloomberg (06/12): US Says Export Controls to Keep Huawei AI Output Limited in 2025

A senior Trump administration official said that Huawei Technologies Co.’s ability to produce AI semiconductors will be very limited this year, responding to US lawmakers’ concerns that China is gaining ground in production of advanced semiconductors.

The Chinese technology giant will be able to make just 200,000 of its Ascend AI chips in 2025, Commerce Under Secretary Jeffrey Kessler said Thursday at a Congressional hearing. Most of those Huawei semiconductors would be delivered within China, he added.

The market for AI accelerators in China was about 1.5 million in 2024, according to the market research firm TechInsights. The country also needs tens of millions of high-end chips for smartphones made by Huawei and other domestic players. For reference, the Stargate data-center project in Texas backed by SoftBank Group Corp. and OpenAI is projected to eventually hold about 500,000 chips

1.2

Bloomberg (06/12): Arm CEO Sides With Nvidia Against US Export Limits on China

Arm Holdings Plc Chief Executive Officer Rene Haas said Thursday that US export controls on China threaten to slow overall technological advances and are ultimately bad for consumers and companies, aligning himself with Nvidia Corp. Chief Executive Officer Jensen Huang and others looking to ease tensions between Washington and Beijing.

“If you narrow access to to technology and you force other ecosystems to grow up, it’s not good,” Haas said Thursday in an interview with Bloomberg at the Founders Forum Global conference in Oxford. “It makes the pie smaller, if you will. And frankly, it’s not very good for consumers.” He also noted that Arm’s footprint in China is “quite significant.”

1.3

CNN (06/12): Nvidia will stop including China in its forecasts amid US chip export controls, CEO says

Chipmaker Nvidia will exclude the Chinese market from its revenue and profit forecasts following the imposition of tough US restrictions on chip sales to China, its CEO said Thursday.

Asked whether the US will lift export controls after trade talks with China in London this week, Nvidia CEO Jensen Huang told CNN’s Anna Stewart in Paris: “I’m not counting on it but, if it happens, then it will be a great bonus. I’ve told all of our investors and shareholders that, going forward, our forecasts will not include the China market.”

1.4

Reuters (06/12): Synopsys restarts some China services, sales of core tools still blocked, source says

Synopsys has resumed offering some services in China, relaxing a suspension it implemented earlier this month to comply with new U.S. export curbs, a source with direct knowledge of the matter told Reuters.

Synopsys resumed some services last week, however, including sales of non-core hardware and intellectual property that allow it to serve some existing clients, said the source, who declined to be named as they were not permitted to speak to the media.

1.5

Nikkei (06/13): Japan, Netherlands' chip exports to China foil US policy: official

The Trump administration will press allies like Japan, South Korea and the Netherlands to comply more with U.S. export controls on China, preventing Beijing from accessing cutting-edge semiconductors, chipmaking equipment and software, a top Commerce Department official told Congress on Thursday.

2. Economy, Finance, and Business

2.1

Bloomberg (06/12): Micron Pledges $200 Billion Investment in US Manufacturing

Chipmaker Micron Technology Inc. said it will spend about $200 billion on US manufacturing, research and development, the latest company to pledge large-scale investments in the country since President Donald Trump won election.

The spending will include roughly $150 billion for domestic manufacturing capacity and another $50 billion for R&D, it said in a statement Thursday. Micron said the total represents an increase of $30 billion beyond what it had previously planned.

2.2

Nikkei (06/12): Taiwan chip titan TSMC opens joint lab with University of Tokyo

Taiwan Semiconductor Manufacturing Co. has launched a joint research laboratory with the University of Tokyo, its first outside of Taiwan, reaffirming the chipmaker's commitment to Japan even as President Donald Trump pushes for increased chip investment in the U.S.

It will promote research focused on "semiconductor technologies with a strong potential for real-world use" across the chip manufacturing process, from material to packaging, the university said in a press release.

2.3

FT (06/12): Oracle shares jump after upbeat forecast for cloud division

Oracle shares jumped following an upbeat forecast on Wednesday when it said its pipeline of cloud computing contracts would more than double next year.

Shares in the $500bn database company rose nearly 8 per cent in after-hours trading in New York as the tech company reported fiscal fourth-quarter revenue rose 11 per cent to $15.9bn, above analysts’ expectation of $15.6bn.

The company said its cloud infrastructure business was expected to grow more than 70 per cent in the next fiscal year, while orders would more than double from $138bn in the same period.

3. Technology

3.1

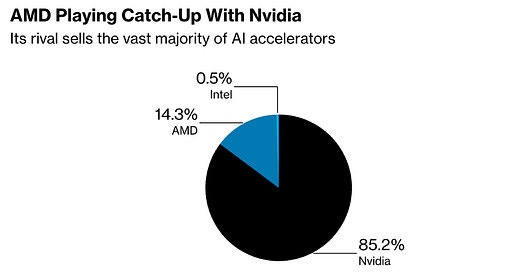

Bloomberg (06/13): AMD Says New Chips Can Top Nvidia’s in Booming AI Chip Field

Advanced Micro Devices Inc. Chief Executive Officer Lisa Su said her company’s latest AI processors can challenge Nvidia Corp. chips in a market she now expects to soar past $500 billion in the next three years.

The new installments in AMD’s MI350 chip series are faster than Nvidia counterparts and represent major gains over earlier versions, Su said at a company event Thursday in San Jose, California. The MI355 chips, which started shipping earlier this month, are 35 times faster than predecessors, she said.

3.2

Reuters (06/12): 'Neocloud' Crusoe to buy $400 million worth of AMD chips for AI data centers

Crusoe CEO Chase Lochmiller said on Thursday the artificial intelligence data center builder planned to purchase roughly $400 million worth of AI chips from Advanced Micro Devices to add to its portfolio of computing power.

The cloud computing startup is aiming to build a data center - or cluster - to house the AMD AI chips in the U.S. and will rent them to customers for building AI models and running applications. Crusoe plans to purchase roughly 13,000 MI355X chips and use a liquid cooling system.

3.3

TrendForce (06/12): Samsung Reportedly Stumbles Again on NVIDIA’s 12-Hi HBM3E Validation, Retest Set for September

Samsung reportedly stumbled in its third attempt to pass NVIDIA’s HBM3E 12-layer validation in June. According to Business Post citing securities analysts, the company now aims for a retest in September.

Though Deal Site previously indicated that that Samsung’s 12-layer HBM3E has passed NVIDIA’s bare-die certification in May, the product still needed to undergo full-package verification. SR Times, on the other hand, suggests that Samsung has been submitting its 8-layer and 12-layer HBM3E for NVIDIA’s testing since the second half of last year.

With Samsung’s 12-layer HBM3E still awaiting NVIDIA’s approval, the reports suggest that hitting its target for mass production in Q4 remains uncertain.

3.4

TrendForce (06/12): Samsung’s 2nm Exynos 2600 Reportedly Enters Prototype Mass Production, Targets 50% Yield

Samsung’s 2nm Exynos 2600 chip—expected to power the Galaxy S26 series in 2026—has now entered the prototype mass production phase.

As noted in the report, Samsung is targeting yields above 50% without compromising performance. If this milestone is reached, the company plans to begin full-scale production in early 2026.

The report also highlights that initial test production earlier this year achieved a yield of only around 30%. This progress marks a significant milestone for Samsung Foundry’s 2nm process, especially given the company’s ongoing yield challenges. According to Chosun Biz, even after three years of mass production, Samsung’s 3nm yields remain at just 50%.

3.5

TrendForce (06/12): HBM5 Expected to Feature Immersion Tech as Cooling Becomes Key to HBM Race

As leading memory makers advance in HBM development, cooling technology is expected to become a key competitive factor once HBM5 enters commercialization—likely around 2029—according to Joungho Kim, a KAIST professor cited by The Elec.

As noted in the report, Kim explains that while packaging is currently the main differentiator in semiconductor manufacturing, the importance of cooling will rise significantly with the arrival of HBM5. He further points out that cooling is becoming increasingly critical as the base die begins taking on part of the GPU’s workload starting with HBM4, resulting in higher temperatures.

KAIST Teralab, headed by Professor Kim, unveils a technology roadmap for HBM4 through HBM8, covering the years 2025 to 2040. The roadmap outlines advancements in HBM architecture, cooling methods, TSV density, interposers, and more. Kim also notes that base dies are expected to shift to the top of the HBM stack through heterogeneous and advanced packaging technologies, as the report indicates.

3.6

Bloomberg (06/12): Nvidia, Samsung Plan Investments in Robotics Startup Skild AI

Samsung Electronics Co. and Nvidia Corp. will take minority stakes in Skild AI Inc. as they seek to bolster their work in the emerging consumer robotics industry.

The South Korean tech leader is making a $10 million investment in Skild, which develops software for robots, according to people with knowledge of the matter. The Santa Clara, California chipmaker is putting in $25 million, said the people, who asked not to be identified discussing unannounced plans.

The financing is part of the company’s Series B funding round, which will value the company at around $4.5 billion and is led by a $100 million investment from Japan’s SoftBank Group Corp.