Daily: Sacks on China chip controls; TI to invest $60b; Samsung and SK Hynix develop 4F DRAM

5.5 min read.

Highlights

Sacks on China chip controls. Trump’s AI advisor David Sacks told Bloomberg that China is becoming good at evading US export controls. This comes off news last week where Sacks said that smuggling chips into China was very difficult. I suppose they could both be true, since China can evade export controls without necessarily physically smuggling in chips. This also comes with news in Reuters today that the Malaysian government has verified that a Chinese firm has used Nvidia’s AI chips through Malaysia.

China evading chip sanctions is not new and has been plaguing the US for years. They tightened the enforcement towards the end of the Biden administration, though it’s been walked back after lobbying from the private sector. We’ll see where the Trump admin takes it next, likely we’ll have to watch how the recent London talks play out in practice.

TI to invest $60b. Texas Instruments plans to invest US$60 billion in the US. These funds will be for building and equipping current plants, as well as the construction of two new Texas fabs. The American company says that the investments were based on business demand.

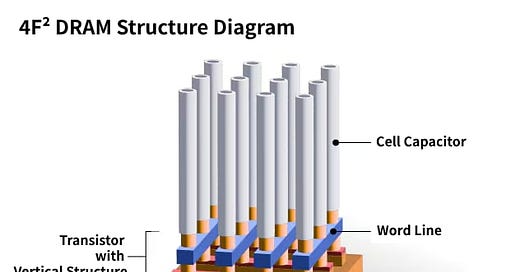

Samsung and SK Hynix develop 4F DRAM. Korea’s Chosun Daily reports that Samsung and SK Hynix are developing 4F² DRAM, which has been talked about as a potential frontier for memory technology for many years now. Industry sources say that both companies aim to develop and test prototypes by the end of this year. Even as the HBM race heats up, this could be a way to innovate further as AI demands memory keep up.

Thanks for reading.

1. Policy and Geopolitics

1.1

Bloomberg (06/18): Trump Adviser David Sacks Says China Adept at Evading Chip Curbs

White House crypto and artificial intelligence czar David Sacks warned that China has grown adept at evading US export controls and is at most two years behind American semiconductor design capabilities.

In a Bloomberg Television interview on Wednesday, Sacks said the US should be concerned that Huawei Technologies Co. is moving fast to catch up to its rivals outside China. He said that DeepSeek’s breakthrough AI model earlier this year demonstrated how China could still advance even with export controls in place.

“Before DeepSeek, people thought that Chinese AI models were years behind and we realized that they are only months behind,” Sacks said.

1.2

Reuters (06/18): Malaysia trade ministry probing reports of Chinese firm's use of Nvidia AI chips

Malaysia's trade ministry is verifying media reports that a Chinese company in the country is using servers equipped with Nvidia and artificial intelligence chips for large language models training, it said on Wednesday.

The ministry "is still in the process of verifying the matter with relevant agencies if any domestic law or regulation has been breached," it said in a statement.

1.3

TrendForce (06/18): Macron: France Must Attain 2–10nm Advanced Semiconductor Manufacturing Capabilities

Recently, during the VivaTech conference in Paris, French President Emmanuel Macron emphasized that France must gain mastery over advanced semiconductor manufacturing processes in the 2 to 10-nanometer range, securing an irreplaceable role in the global technology supply chain.

In recent years, France has sought breakthroughs in the semiconductor field through policy support, industry-academia-research collaboration, and international cooperation. Currently, the country’s strengths lie primarily in mature manufacturing processes and specific application domains.

The “France 2030” investment plan identifies semiconductors as one of seven key disruptive innovation areas, with Euro 5.5 billion earmarked for the sector by 2030. Of this, Euro 2.9 billion has already been allocated to support the Euro 7.5 billion joint wafer fab project between STMicroelectronics and GlobalFoundries. Located in Crolles, this facility is expected to reach full capacity by 2028, with an annual output of 620,000 18nm wafers targeting strategic markets such as automotive electronics and the Internet of Things (IoT).

2. Economy, Finance, and Business

2.1

Bloomberg (06/18): Intel Brings in New Engineering Leaders to Help AI Comeback

Intel Corp. named new engineering leadership as part of a turnaround effort under Chief Executive Officer Lip-Bu Tan, tapping veterans of Cadence Design Systems Inc., Apple Inc. and Google.

The executives — Srinivasan Iyengar, Jean-Didier Allegrucci and Shailendra Desai — will be joining Intel in key engineering roles, the company said on Wednesday. As part of the changes, Intel also elevated sales head Greg Ernst to the position of chief revenue officer.

2.2

Bloomberg (06/18): Texas Instruments Touts Plans to Invest $60 Billion in the US

Texas Instruments Inc. touted plans to spend more than $60 billion on semiconductor plants in the US, making it the latest chipmaker to promote its domestic manufacturing ambitions as the Trump administration urges investments and threatens to upend the sector with tariffs.

The company said its long-term capital spending plan remains unchanged. The total includes amounts allotted to plants that are already being built and equipped in the process of bringing them up to full production. The chipmaker will begin construction of two new factories at its site in Sherman, Texas, based on business demand.

2.3

TrendForce (06/18): ASIC Boom by 2027? CSPs Aim to Leapfrog NVIDIA with Custom Chips — Key Moves & Partners

NVIDIA still leads in the AI chip race, but its global AI infrastructure push recently may reflect concerns that hardware growth may slow—and that CSPs ramping up ASIC development could become serious challengers. According to Commercial Times, as Google, Microsoft, and Meta ramp up in-house ASIC development, NVIDIA’s grip on the AI accelerator market could face a turning point by 2027.

Notably, Taiwanese ASIC firms like Alchip and TSMC-affiliated GUC are riding the wave of growing demand, collaborating with AWS and Microsoft on custom chip designs, as highlighted by the report. Here’s a quick look at the latest ASIC moves by cloud giants and their key design partners.

Among U.S. CSP giants, Google leads with its TPU v6 Trillium, which offers improved energy efficiency and performance for large-scale AI models, according to TrendForce. Google has also expanded from a single-supplier model (Broadcom) to a dual-sourcing strategy by partnering with MediaTek, as per TrendForce.

Meanwhile, AWS is making strides in custom chips too—CNBC reports that Anthropic’s Claude Opus 4 runs on AWS’s Trainium2, with Project Rainier using over 500,000 of them. These are workloads that once would’ve gone to NVIDIA, the report adds.

3. Technology

3.1

Chosun Daily (06/18): Samsung and SK hynix advance 4F² DRAM as gateway to 3D memory

Samsung Electronics and SK hynix are accelerating the development of next-generation three-dimensional (3D) dynamic random-access memory (DRAM), with both companies aiming to complete and test early prototypes of vertically structured “4F² DRAM” by the end of this year, according to industry sources.

The 4F² DRAM architecture marks a departure from conventional planar DRAM, adopting a vertical stacking approach to overcome the miniaturization limits of existing structures. The design is expected to deliver improvements in performance, data transfer rates, and energy efficiency. Both Samsung Electronics and SK hynix are positioning 4F² DRAM as a transitional step toward full-fledged 3D DRAM technology.

DRAM stores information in units known as cells, with the area of each cell typically represented as F². The standard architecture to date has been the 6F² cell, featuring three vertical bit lines and two horizontal word lines. The 4F² concept reduces both to two lines, while positioning the transistor—the functional switch within each DRAM cell—vertically to increase density and shrink chip size.

3.2

FT (06/18): Bill Gates and Sam Altman’s nuclear groups raise $1bn as investors bet on AI

Two companies backed by Bill Gates and Sam Altman have raised more than $1bn amid a surge in investor optimism that nuclear energy will help power the artificial intelligence revolution.

TerraPower, a private company founded by Gates, said on Wednesday it had raised $650mn from investors, including attracting funding for the first time from the venture capital arm of US chipmaker Nvidia.

It follows a $460mn equity raise closed this week by Oklo, the Altman-backed listed developer of small modular reactors, a new type of nuclear reactor that generates about a third or less power of the power of standard models.