Daily: U.S.-China tech competition; SMIC streamlines for advanced nodes; Kioxia to double output

6.5 min read.

Highlights

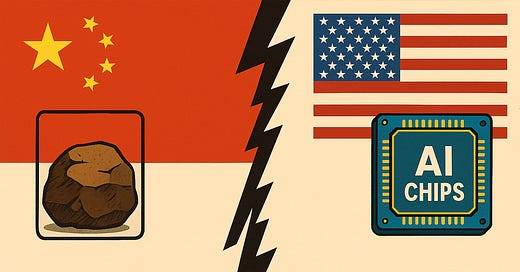

U.S.-China tech competition. U.S.-China tech / trade competition heats up, with both sides signalling ability to escalate. China’s restrictions of rare earths through a licence system mirrors U.S.’ restrictions of advanced semiconductors. The Biden-era AI Diffusion Rule is being scrapped for something else, though it isn’t yet clear what it is. Commerce Sec. Howard Lutnick suggests that new rules could give chip access to U.S. allies on the condition that they be operated by U.S. companies.

SMIC streamlines for advanced nodes. SMIC sold off a subsidiary that produces older chips, in a strategic move to focus on advanced nodes, including 7nm, 5nm, 3nm. It is incredible that they can do this without EUV photolithography and chip sanctions.

Kioxia to double output. Kioxia, the Japanese memory company, plans to double output over five years, to meet the increased demand for NAND flash in AI data centres. They will develop a new kind of NAND tailored for speed required in AI applications.

Elsewhere in memory, SK Group chairman Chey Tae-won, said that the AI memory business is becoming more specialised and reliant on a small number of customers. Over the past year or so, SK Hynix’s market position has been boosted by being the sole supplier of HBMs for Nvidia’s cutting-edge AI chips.

Thanks for reading.

1. Policy and Geopolitics

1.1

FT (06/08): China arms itself for more export control battles

China’s success in snarling global supply chains by stemming the flow of rare earths has piled pressure on Washington and made clear Beijing’s power to weaponise export controls on a wider range of critical goods, analysts and businesspeople say.

China dominates the supply chain for key minerals and its commerce ministry started requiring licences for exports of rare earths and related magnets in early April. The slow approval process has rocked global supply chains and given Beijing leverage over the US after Donald Trump’s sweeping “liberation day” tariffs.

There are now hopes more licences will be issued after Trump and China’s President Xi Jinping spoke on Thursday, paving the way for a new round of trade talks in London on Monday. On Saturday Beijing signalled a faster approvals process for some European companies.

However, Xi’s recent deployment of export controls has shifted the balance of power in US-China trade talks back to Beijing, experts said.

1.2

Bloomberg (06/06): Lutnick Urges Tougher Enforcement of Export Curbs on China

Commerce Secretary Howard Lutnick called for stepped up enforcement of US export controls to prevent China from stealing critical American technologies that could support Beijing’s ambitions in areas like artificial intelligence and aviation.

“They are trying to copy our technology,” Lutnick said Thursday during a House Appropriations subcommittee hearing on the Commerce Department’s budget. “In the race for AI supremacy, they are behind us, but they are working with the central government to get us, right, to beat us so that they will have intellectual superiority over us.”

Lutnick argued for more funding for the department’s Bureau of Industry and Security, which oversees export control efforts. He said the additional resources would help expand the number of agents who visit warehouses and exporters to ensure compliance with US limits on sales to China and other American adversaries. Lutnick said he wants to post more than two BIS agents inside China to boost enforcement efforts.

1.3

TrendForce (06/06): U.S. Reportedly to Allow AI Chip Exports to Allies If Run by Approved U.S. Operators Soon

Just weeks after Trump hit pause on Biden’s sweeping AI Diffusion Rule—which tried to rank every country in a strict three-tier system—Commerce Secretary Howard Lutnick reportedly teased a revamped version is coming pretty soon, though he could not provide a specific timeline.

Speaking on June 4, Lutnick revealed that the new rule will give U.S. allies access to AI chips—under one key condition: the chips must be run by approved American cloud and data center operators, according to Export Compliance Daily.

2. Economy, Finance, and Business

2.1

Bloomberg (06/06): Broadcom Falls After Lukewarm Forecast Disappoints AI Bulls

Shares of Broadcom Inc., a chip supplier to companies like Alphabet Inc. and Apple Inc., fell after the company gave a lackluster revenue forecast for the current quarter, suggesting that the AI spending frenzy isn’t as strong as some investors anticipated.

Sales will be about $15.8 billion in the fiscal third quarter, which ends Aug. 3, the company said in a statement Thursday. Though analysts had estimated $15.7 billion on average, some projections ranged $1 billion higher than that figure, according to data compiled by Bloomberg.

The outlook signals that investor expectations for Broadcom’s AI-fueled growth run were too aggressive. Like Nvidia Corp., the company is seen as a key beneficiary of a surge in artificial intelligence spending. Data center companies rely on its custom chips and networking components to handle AI computing workloads.

Broadcom’s stock fell as much as 4.5% after markets opened in New York on Friday. The shares had been up 12% this year through Thursday’s close.

2.2

TechCrunch (06/06): AMD acqui-hires the employees behind Untether AI

AMD is continuing its acquisition spree.

Semiconductor giant AMD acqui-hired the team behind Untether AI, a startup that develops AI inference chips, as originally reported by CRN. Untether claims that their chips are faster and more energy-efficient than their rivals. The terms of the deal weren’t disclosed.

Toronto-based Untether was founded in 2018 and has raised more than $150 million in venture capital from firms including Intel Capital, Radical Ventures, and Tracker Capital Management, among others.

2.3

TrendForce (06/06): SMIC Offloads Ningbo Stake to Local Chipmaker Goke Micro in Strategic Move

Amid China’s semiconductor consolidation wave to push back against U.S. pressure, local foundry giant SMIC announced on June 5 it is selling its full 14.83% stake in SMIC Ningbo to Shenzhen-listed Goke Microelectronics, according to Sina and the Science and Technology Innovation Board Daily.

Per Goke Microelectronics’ filing cited by the reports, it will also buy shares from 10 other stakeholders—including China’s state-backed Big Fund—using a mix of shares and cash. Once complete, the chipmaker will own 94.37% of SMIC Ningbo, with SMIC fully exiting the subsidiary, the reports suggest.

Notably, Sina points out that for SMIC, offloading its stake in SMIC Ningbo is not just a routine asset sale, but a strategic move to sharpen its focus and upgrade its core business.

Sina says SMIC has been focusing heavily on advanced nodes, moving from 14nm mass production to breakthroughs in 7nm and 3nm. This move, therefore, shows its plan to streamline assets and invest more in sub-7nm nodes and specialty processes, strengthening its lead in high-end chip making, the report adds.

2.4

TrendForce (06/06): Kioxia Plans to Double Output in Five Years, Ramping Up NAND Flash for AI Data Centers

Japanese NAND flash memory giant Kioxia announced its mid- to long-term business plan on June 5, aiming to double its production capacity by fiscal 2029 compared to fiscal 2024 by expanding production lines at its two main facilities in Japan—the Yokkaichi and Kitakami plants—to support growing demand for NAND flash used in AI data centers. The report also notes that Kioxia plans to begin manufacturing next-generation memory in the second half of 2026.

The next-generation memory Kioxia plans to produce—known as Storage Class Memory (SCM)—offers faster data read speeds than NAND flash and higher storage capacity than the DRAM currently used in AI applications, as the report highlights. The report notes that mass production is expected to begin once the technology is validated by AI semiconductor manufacturers.

2.5

TrendForce (06/06): Intel Reportedly Demands 50% Margins for New Products in Profitability Push

Intel has stopped approving new projects unless they can demonstrate a projected gross margin of at least 50%, based on industry expectations, as stated by Intel Products CEO Michelle Johnston Holthaus.

Notably, all of its upcoming roadmap products—including Panther Lake and Nova Lake—are currently expected to meet the 50% gross margin target the company is aiming for, according to the report.

Intel’s gross margin fell to 36.9% in Q1 2025, according to the company’s press release. As the report highlights, this marks a sharp decline from the roughly 60% margin Intel maintained for a decade prior to the COVID-19 pandemic.

2.6

Nikkei (06/06): Memory chip business to rely more on select customers: SK Group chairman

The AI memory chip business is becoming more specialized but also more reliant on a small number of "locked-in" customers, according to SK Group Chairman Chey Tae-won.

SK Hynix, the South Korean group's chip company, has made a name for itself amid the artificial intelligence boom as the primary supplier of high bandwidth memory (HBM) chips to Nvidia of the U.S.

3. Technology

3.1

Yonhap (06/08): Samsung Electronics to adopt AI coding assistant to boost developer productivity

Samsung Electronics Co. said Sunday it will adopt an artificial intelligence (AI) coding assistant service called Cline next month to enhance productivity among its software development employees.

In a recent internal notice, the company said it has launched a beta test of Cline for employees in the Device eXperience (DX) division, which includes its mobile, TV and home appliances businesses.

Cline is an open-source AI tool that helps developers write, edit and test code using simple natural language commands like "create a login function." Unlike conventional coding assistants limited to basic tasks, Cline can handle more complex software development processes, significantly boosting productivity.

-