Highlights

Xi warns overcapacity. Xi Jinping warns local governments against over-investment and overcapacity in critical technologies, including in AI. For instance, local and regional governments are rushing to build data centres even though there aren’t enough chips to go around or technical know-how to run them properly. The NYT did a long piece last week on how inefficient China’s AI push is.

HBM demand climbs. A Goldman Sachs report suggests that HBM prices may decline due to competition, but demand will still grow from GPUs and custom-built AI chips, growing up to 80% for the latter category next year.

Rocky H20 resumption. The resumption of H20 sales may not be so smooth initially. Nvidia can sell idle inventory to start but resuming the production of new chips can take 9 months, as TSMC has already repurposed its H20 lines for other customers. Moreover, the US House Select Committee on China, including Republicans, were critical of the Trump administration’s decision to allow H20 sales again, arguing that it risks U.S.’ ability to compete with China on AI.

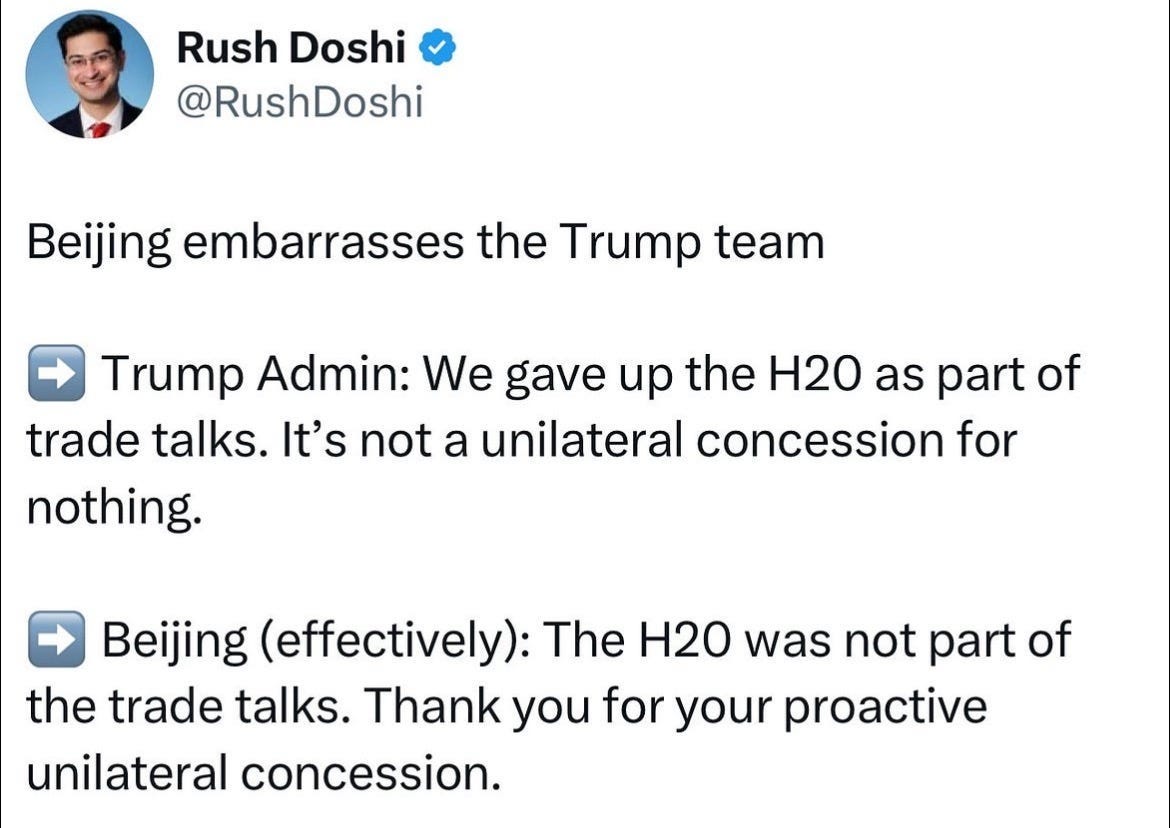

Over the weekend, Rush Doshi, former Director for China at Biden’s National Security Council, tweeted that Beijing said that the H20 deal was not part of the trade deal for rare earths. Beijing is trolling D.C. and seems to consider the H20 deal a ‘free win’.

Thanks for reading.

1. Policy and Geopolitics

1.1

FT (07/18): Xi Jinping warns Chinese officials against over-investment in AI and EVs

Chinese President Xi Jinping has issued an unusually blunt warning to local governments against over-investment in artificial intelligence and electric vehicles, as vicious price wars fuel deflation in the world’s second-largest economy.

The comments, in which Xi attacked what he called “three pats officials” who evade responsibility for reckless investment plans, will strengthen market expectations that Beijing will intervene in the AI, EV and other industries it believes are suffering from over-investment.

Local governments across China, including in remote and sparsely populated regions such as Xinjiang and Inner Mongolia, have rushed to construct data centres in a bid to capitalise on the boom in AI usage.

But the Financial Times has reported that many of these projects suffer from a lack of technical knowhow and have wasted critical chip resources.

1.2

Bloomberg (07/18): House China Panel Faults Trump’s Move to Ease Nvidia AI Chip Sales

The Trump administration’s decision allowing Nvidia Corp. to resume shipments of its H20 artificial intelligence chips to China risks bolstering Beijing’s military capabilities and expanding its capacity to compete with the US in AI, according to the head of the US House Select Committee on China.

“The H20, which is a cost-effective and powerful AI inference chip, far surpasses China’s indigenous capability and would therefore provide a substantial increase to China’s AI development,” Chairman John Moolenaar, a Michigan Republican, said Friday in a letter to Commerce Secretary Howard Lutnick, whose agency oversees semiconductor export controls. “We must not allow US companies to sell these vital artificial intelligence assets to Chinese entities.”

1.3

Bloomberg (07/18): Taiwan Aims to Ensure Its Security With Tech Export Controls

Taiwan is trying to ensure that technology built domestically is not used to compromise the security of its people by imposing certain export curbs on a number of major Chinese companies.

Hsiao said that Taiwan will continue to engage with its partners on its export control policies to defend and secure values that are important to the Taiwanese society. Taiwanese officials have said that export controls are part of the ongoing US-Taiwan trade talks, and President Lai Ching-te has also pledged to close loopholes, a long-standing concern for Washington.

2. Economy, Finance, and Business

2.1

Reuters (07/19): Nvidia's China restart faces production obstacles, The Information reports

Nvidia has told its Chinese customers it has limited supplies of H20 chips, the most powerful AI chip it had been allowed to sell to China under U.S. export restrictions, The Information reported on Saturday.

The U.S. government's April ban on sales of the H20 chips had forced Nvidia to void customer orders and cancel manufacturing capacity it had booked at chipmaker Taiwan Semiconductor Manufacturing said the report in tech publication The Information, citing two people with knowledge of the matter.

TSMC had shifted its H20 production lines to produce other chips for other customers, and manufacturing new chips from scratch could take nine months, Nvidia CEO Jensen Huang said at a media event in Beijing this week, according to the report.

2.2

TrendForce (07/21): HBM Demand from ASICs Reportedly to Surge 80% in 2026, Fueling Samsung–SK hynix–Micron Rivalry

While Goldman Sachs expects HBM prices to decline next year as competition intensifies and pricing power shifts to major customers, the firm also notes that although GPUs will remain the main growth engine, ASICs are set to see even faster adoption in 2026. Building on this, Chosun Biz notes that the once GPU-dominated HBM market is rapidly diversifying, paving the way for fierce competition among Samsung, SK hynix, and Micron.

As demand surges for custom-built AI chips, the ASIC (Application-Specific Integrated Circuit) market is booming—and cloud giants like Amazon, Google, and Meta are emerging as major buyers in the HBM space.

As per Goldman Sachs, more AI ASICs are now switching from LPDDR and GDDR to HBM—with memory content per chip rising fast. Meanwhile, TrendForce reports that cloud service providers are ramping up ASIC development to cut dependence on NVIDIA and AMD—fueling broader HBM adoption.

2.3

Bloomberg (07/18): Nvidia Rally Shows Signs of Overheating as Gains Blow Past 80%

Nvidia Corp. traders keep getting reasons to buy the stock, but the breakneck rally is showing signs of overheating.

The chipmaker’s 14-day relative strength index briefly topped 80 on Friday, the highest since June 2024 when the stock dropped more than 20% over the following six weeks. The momentum gauge tracks the speed of a stock’s recent price changes and a reading over 70 is a signal to some analysts that buying is at extreme levels.

2.4

Bloomberg (07/18): Chip Designer Semifive Files for Pre-IPO Review in South Korea

Chip design firm Semifive Inc. filed a preliminary application for an initial public offering in Seoul, seeking to spur its growth to tap rising demand for semiconductors in fields such as artificial intelligence.

Founded in 2019, Semifive began as a step between design companies and foundries, turning semiconductor concepts into manufacturable layouts. It has since evolved into a provider that covers a larger part of the value chain — from design and intellectual property integration to mass production. Key partners include Korean AI chip startups FuriosaAI Inc. and Rebellions Inc.

3. Technology

3.1

Bloomberg (07/18): Japan Inches Toward AI Goals With Rapidus’ First Chip Prototype

Japan’s Rapidus Corp. has prototyped an advanced chip, an early step in the government-backed startup’s attempt to leapfrog years of innovation with the help of billions of dollars in public funding.

The company last week printed circuitry on wafers using 2-nanometer gate-all-around process technology, President Atsuyoshi Koike told reporters Friday. He did not disclose the number of functional chips produced.

Rapidus, which in April began developing wafers using extreme ultraviolet lithography equipment from ASML Holding NV, aims to be ready to help customers with their chips by March, Koike said. The company, which hopes to mass produce cutting-edge semiconductors by 2027, remains far behind industry leader Taiwan Semiconductor Manufacturing Co.’s plans to begin volume production of its 2nm process later this year.

3.2

Tom’s Hardware (07/20): Nvidia's CUDA platform now supports RISC-V

At the 2025 RISC-V Summit in China, Nvidia announced that its CUDA software platform will be made compatible with the RISC-V instruction set architecture (ISA) on the CPU side of things. The news was confirmed during a presentation during a RISC-V event. This is a major step in enabling the RISC-V ISA-based CPUs in performance demanding applications.

The announcement makes it clear that RISC-V can now serve as the main processor for CUDA-based systems, a role traditionally filled by x86 or Arm cores. While nobody even barely expects RISC-V in hyperscale datacenters any time soon, RISC-V can be used on CUDA-enabled edge devices, such as Nvidia's Jetson modules. However, it looks like Nvidia does indeed expect RISC-V to be in the datacenter.

3.3

TrendForce (07/21): Huawei to Unveil CloudMatrix 384, Rumored to Deliver 2× NVIDIA GB200 NVL72 Throughput

Huawei is reportedly set to unveil its CloudMatrix 384 system for the first time at the 2025 World Artificial Intelligence Conference (WAIC), which opens on the 26th in Shanghai, according to Economic Daily News. As highlighted by Tom’s Hardware, the CloudMatrix 384 is a rack-scale AI system composed of 384 Ascend 910C processors, interconnected through a fully optical, all-to-all mesh network.

Although a single Ascend 910C chip delivers only about one-third the performance of NVIDIA Blackwell, the report notes that Huawei offsets this limitation by deploying a much larger number of chips per system. This approach allows the CloudMatrix 384 to achieve around 300 PFLOPs of dense BF16 compute—nearly twice the throughput of NVIDIA’s GB200 NVL72, which offers about 180 PFLOPs, as the report highlights.